QuickBooks isn’t just clunky — it’s costing you momentum. Manual...

Read MoreBlogs

How To Get Fast Business Loans Up To $75 Million (Even When Banks Drag Their Feet)

Most growing companies do not realize that nearly all banks...

Read MoreUnlocking Growth Potential Through Capital: What You Need to Know

Perfect! Here’s a fully Elementor-ready blog post, formatted with headings,...

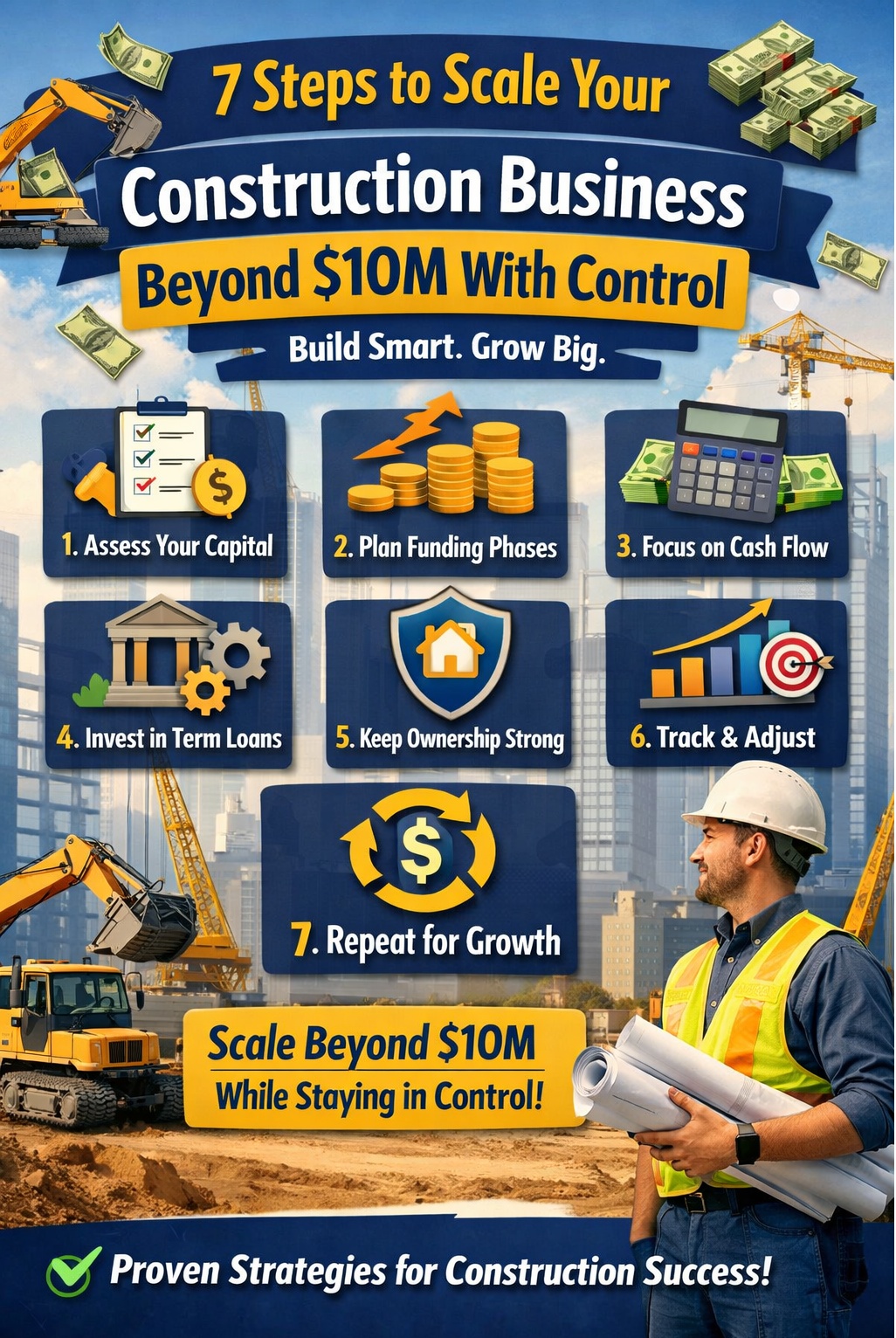

Read More7 Steps to Scale Your Construction Business Past $10M

Hitting the $10M mark in construction isn’t about landing one...

Read More