Puzzle: The Modern QuickBooks Alternative You’ve Been Waiting For

QuickBooks isn’t just clunky — it’s costing you momentum. Manual categorization, reconciliations, and cleanup can steal your week, leaving you frustrated and behind. If your finance operations feel like duct tape holding together spreadsheets and broken automations, it’s not you — it’s the tool. Puzzle replaces the manual grind with AI bookkeeping that’s accurate, timely, and easy to trust. What Makes Puzzle Different? Puzzle is more than accounting software — it’s an AI-driven bookkeeping platform designed to save you time and give you clear financial insights. Unlike traditional tools, Puzzle ensures your books show up on time, without hacks or tedious manual work. Key benefits: Automatic categorization of transactions Real-time reconciliations without errors AI-driven insights for faster decision-making Clean, skimmable reports you can trust Step-by-Step: How Puzzle Works Connect Your Accounts – Link your bank, credit cards, and payment platforms in minutes. Automatic Categorization – Puzzle’s AI sorts transactions into the correct accounts automatically. Reconciliations Done for You – Daily checks ensure your books are always accurate. Insights & Reports – Generate real-time dashboards and profit/loss statements without lifting a finger. Review & Action – Quickly spot anomalies or trends and make informed business decisions. Visuals and dashboards make these steps easy to follow and digest. Puzzle vs QuickBooks: A Side-by-Side Comparison Feature QuickBooks Puzzle Automation Limited, manual setup AI-driven, fully automated Reporting Slow, clunky Real-time, skimmable Accuracy Dependent on manual input AI ensures consistent accuracy Ease of Use Steep learning curve Intuitive, user-focused design Support Standard support Dedicated customer success team Case Studies & Real Data Case Study 1: A growing e-commerce business saved 12 hours per week by switching to Puzzle from QuickBooks. Case Study 2: An accounting firm reduced reconciliation errors by 85% using Puzzle’s AI automation. Testimonials: “Puzzle transformed our bookkeeping. I actually enjoy looking at our reports now.” — Maria L., small business owner “The AI catches things we used to miss. No more late numbers holding up decisions.” — Dan R., CFO Security: Puzzle uses bank-level encryption and two-factor authentication to keep data safe. Pricing: Flexible plans scale with your business, no hidden fees. Ease of Use: Designed for non-accountants — setup takes minutes, not weeks. Why Choose Puzzle? Puzzle gives you confidence that your books are accurate, timely, and actionable. Decisions no longer have to wait for late numbers, and your finance team can focus on strategy instead of manual grunt work. See Puzzle in action with a free trial or demo. No pressure — decide at your pace and experience how AI bookkeeping can transform your workflow. Puzzle replaces the frustration of QuickBooks with AI-powered automation, real-time insights, and easy-to-read reports. With step-by-step automation, comparison data, testimonials, and answers to security, pricing, and ease-of-use questions, it’s the modern solution for businesses that don’t want to waste time on manual bookkeeping.

How To Get Fast Business Loans Up To $75 Million (Even When Banks Drag Their Feet)

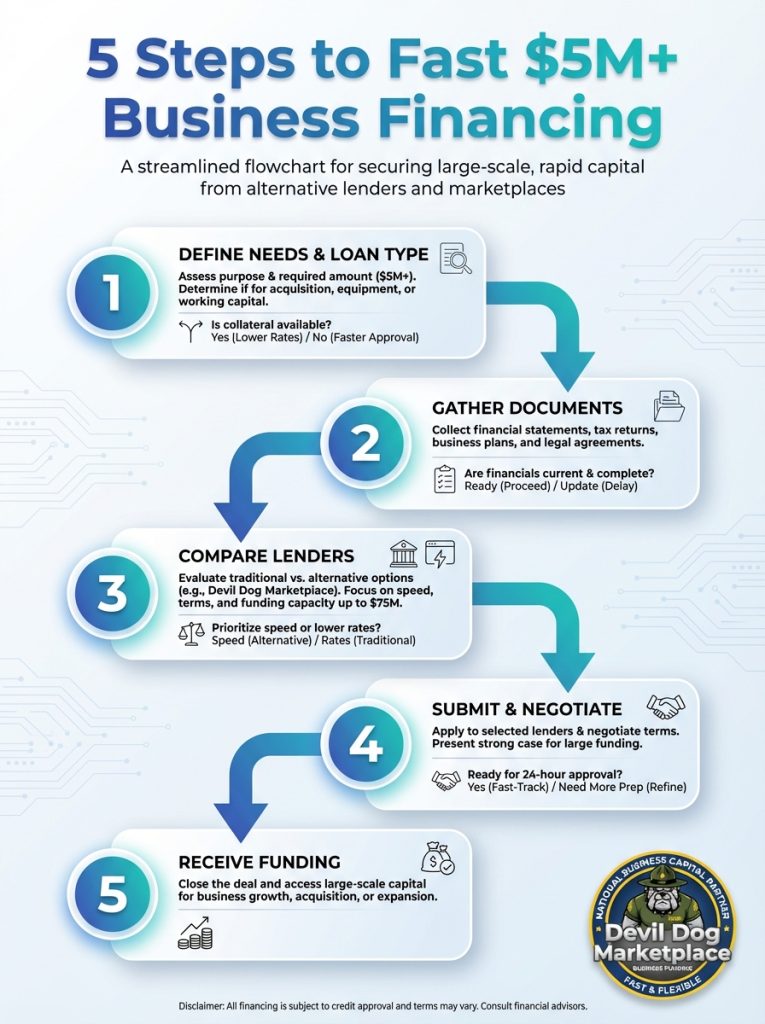

Most growing companies do not realize that nearly all banks will lend at least $1 million and about half will go up to $3 million, yet many still get stuck in slow processes or flat-out declines when they need funding fast. We built a business capital marketplace so you can move past those delays and access large business loans, flexible funding solutions, and true partnership when you are aiming for $1 million to $75 million in growth capital. Key Takeaways Question Answer How fast can I get a $5 million business loan? With a prepared financial package, we often see approvals for $1M+ in a few days and in some cases funding within 24 hours from alternative business lenders through our funding solutions. What is a business capital marketplace? It is a centralized platform where we bring together many alternative business lenders so you can compare term loans, lines of credit, equipment financing, and acquisition funding in one place instead of applying one by one at banks. Can I get business capital without collateral? Yes, we regularly see unsecured working capital loans and revenue based funding, especially for businesses with strong cash flow and clear plans for large business growth. Do you fund only local companies in Florida? We support companies nationwide, but we have deep experience with business loans in West Palm Beach, South Florida commercial loans, and deals across Palm Beach County’s active real estate and construction markets documented throughout our Devil Dog Marketplace platform. What types of deals are best for $1M+ fast business funding? Business acquisition financing, equipment financing above $500K, large working capital lines of credit, and construction or manufacturing expansions where timing is critical. Do you work with veterans? Yes, as a veteran-led team we take business loans for veterans seriously and help owners understand both marketplace options and government-backed programs, starting with a simple conversation on our contact page. 1. What Large Business Loans Up To $75 Million Really Look Like When you hear “business loans up to $75 million,” it can sound like something reserved only for massive corporations. In reality, we see mid-market companies, fast growing regional brands, and family-owned operations qualify for large business loans when they have solid revenue, clear uses for capital, and realistic repayment plans. From $1M Fast Funding To $75M Strategic Capital On our platform, lenders commonly provide flexible term loans, large working capital facilities, and acquisition lines that range from $1 million to $75 million. These deals often blend multiple structures, like a core term loan for a business acquisition plus a revolving line of credit for working capital. Why Many Owners Outgrow Traditional Banks Banks can be a fit for some needs, but they are often slower and more rigid when businesses want to move on an acquisition or expansion quickly. We positioned our business capital marketplace specifically as an alternative to bank business loans when speed, flexibility, and creative structures matter more than a single low advertised rate. Real Example: Multi-Million Dollar Working Capital For Growth One of our featured stories highlights a company that secured a seven-figure working capital loan to support rapid expansion after banks hesitated because of previous losses. By focusing on forward-looking cash flow and contracts, not just historical hiccups, our lending partners were able to fund fast and keep the growth plan moving. 2. How A Business Capital Marketplace Beats One-Size-Fits-All Lending A business capital marketplace is built around one idea, which is that no single lender is the right answer for every deal. Instead of pushing you toward one product, we match your business with a curated set of alternative business lenders that specialize in your size, industry, and purpose. Centralized Access To Multiple Lenders We work with a network that can fund up to $75,000,000 in business capital, with programs for term loans, lines of credit, and specialized equipment financing over $500K. You complete one clear application, then our advisors help you compare structures, rates, and timelines so you can choose your best fit. Everything Banks Don’t Offer Where banks tend to rely heavily on rigid underwriting and collateral, alternative lenders can lean into cash flow, contracts, and future potential. That makes it easier to secure business capital without collateral, especially for working capital loans and revenue based terms. Support, Not Sales Pressure We approach each request like a mission brief: clear questions, straight answers, and no pressure. Our advisors help you understand tradeoffs between term loans, short term working capital, and lines of credit so you stay in control of your financing strategy. 3. Fast Business Funding $1 Million+ And 24 Hour Approvals Speed of funding is not a luxury when payroll, acquisition timelines, or equipment deliveries are on the line. That is why fast business funding for $1 million and above is one of the core pillars of our marketplace. How To Get A $5 Million Business Loan Fast If you want to know how to get a $5 million business loan fast, the key is preparation. We help you organize current financials, a clear use of funds, projections, and any contracts or LOIs so lenders can underwrite in hours instead of weeks. What 24 Hour Approval Really Means When we say business funding with 24 hour approval, we are talking about conditional approvals or offers from flexible alternative lenders, often followed by funding within a few days. For repeat clients with strong track records, we sometimes see money wired in less than 24 hours once documentation is complete. Real-World Example: One Million Business Loan Payment In our “One Million Business Loan Payment” feature, we highlight a company that secured a seven figure facility, used it to drive growth, then repaid on schedule and accessed additional funding later. That kind of long term funding relationship is possible when a lender priorities transparency, performance, and communication over one-time transactions. Discover a 5-step path to fast $5M+ financing for large businesses. Learn how alternative lenders, equipment financing, and working capital can accelerate growth in

Unlocking Growth Potential Through Capital: What You Need to Know

Perfect! Here’s a fully Elementor-ready blog post, formatted with headings, bullet points, and subtle calls-to-action (CTAs). It keeps the Ari Galper voice, 8th-grade readability, and SEO keywords. You can copy/paste this directly into Elementor blocks: Many business owners think about capital in a transactional way. They see funding as something you only use when things get tight—like a short-term fix to a problem. Once the issue is solved, the money disappears from the conversation. But as a business grows, this mindset can hold you back. Cash keeps the lights on, but it rarely changes the foundation of a business. If you want to expand your capacity, acquire new companies, upgrade suppliers, or invest in infrastructure, you need something more: capital that is deliberate and aligned with the business you’re building. What is Strategic Business Capital? The companies that grow intentionally don’t just wait for cash problems to show up. They take a different approach. They understand that periods of deliberate strain—what we call Strategic Red—are a natural part of growing ahead of your current cash cycle. Strategic business capital is not about reacting to problems. It’s about planning for growth. It’s funding that supports intentional business scaling and helps you build the business you actually want to have. Why Strategic Red Matters Taking on funding can sometimes feel counterintuitive. Tightening cash while adding leverage might seem risky. But this isn’t reckless—it’s preparation. Think of it like training for a marathon: you push your limits before the race so that when the big day comes, you’re ready. Strategic Red is the financial version of that. How Growth Capital for Businesses Works Growth capital for businesses gives you the power to: Expand operations without waiting for profits to catch up Upgrade equipment or technology to increase efficiency Invest in infrastructure that supports long-term growth Take advantage of strategic acquisitions This is what capital for business expansion looks like—money that changes the structure of your business, not just keeps it running. The Power of Intentional Business Scaling The difference between surviving and thriving is intention. Companies that scale with intention make deliberate choices about where to invest and when. They understand that short-term strain can create long-term advantage. That’s the power of deliberate business growth. By planning ahead, aligning funding with goals, and understanding the rhythm of Strategic Red, businesses don’t just survive—they thrive. Take Action If you’re ready to move beyond transactional funding and use capital as a blueprint for growth, start by asking yourself: What growth goals do I want to achieve in the next 12–24 months? Which parts of my business need deliberate investment to scale? Am I prepared to embrace Strategic Red to fuel long-term success? Strategic business capital isn’t about reacting—it’s about building the business you actually want.

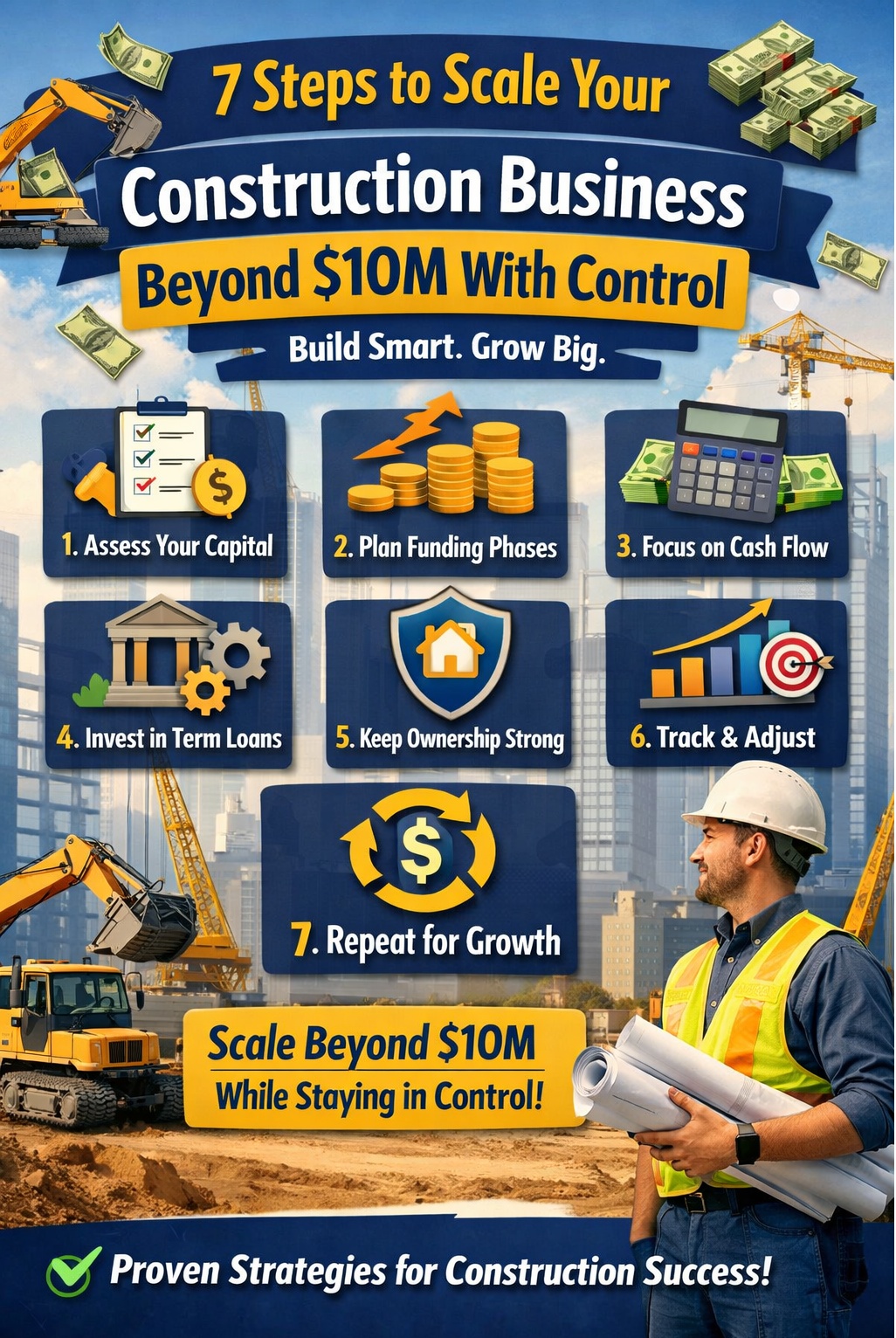

7 Steps to Scale Your Construction Business Past $10M

Hitting the $10M mark in construction isn’t about landing one big project—it’s about having the right capital plan in place. If you’ve ever felt stuck, watching opportunities slip by because you didn’t have cash or equipment ready, you’re not alone. Many contractors assume that securing funding is a one-time fix. In reality, without a structured funding approach, extra money can create more stress than solutions. Brasfort*, a construction firm we partnered with, faced this exact challenge. They wanted fast growth—but growing without a plan can easily overwhelm a business. Over 3.5 years, they carefully deployed nearly $5 million across ten strategic funding phases, each aligned with a specific operational goal. The payoff? Revenue doubled, margins improved, equipment ownership increased, and operational control stayed firmly in their hands. In this article, you’ll discover 7 actionable steps to organize funding like Brasfort, helping your construction business surpass $10M while maintaining ownership, control, and clarity. Step 1: Take a Clear Look at Your Current Capital Before pursuing more funding, you need to know exactly where you stand financially. Consider: How much debt is already on the books? Which assets are leased, and which are owned? Where are your cash flow gaps in the short and long term? Why it matters: Without understanding your starting point, you risk borrowing money that doesn’t solve the right problem. Brasfort documented every asset, liability, and project expense, giving us a clear foundation for planning future rounds. Actionable Steps: List all current assets and liabilities. Highlight recurring cash shortfalls. Rank funding priorities based on impact and urgency. Step 2: Plan Funding in Phases Rather than seeking a single large loan, split funding into phases tied to operational objectives. Brasfort implemented 10 rounds of Cash Flow Financing, each supporting equipment, projects, or internal systems. Benefits of phased funding: Limits the risk of over-borrowing Ensures capital supports real operational needs Makes business growth predictable and repeatable How to start: Identify 3–5 growth objectives for the next 1–3 years. Assign a dedicated funding round to each objective. Align repayment schedules with project timelines. Step 3: Focus on Cash Flow, Not One-Off Jobs Funding is most effective when it’s strategically planned, not just reactive. Many companies borrow only when a big project arises, which creates stop-and-go growth. Brasfort’s approach: Rolling Cash Flow Financing allowed them to be ready for projects at any time No downtime between jobs, fewer missed opportunities How to apply this: Maintain a 3–6 month funding reserve Keep a buffer for equipment and unexpected project needs Avoid using borrowed money for unrelated expenses Step 4: Use Term Loans for Long-Term Improvements Short-term loans solve immediate problems—but strategic, long-term growth requires deliberate investment. Brasfort used a Term Loan to strengthen internal systems, making operations scalable. Actionable Steps: Identify gaps in core operations (project management, finance systems, HR, ERP) Estimate how much capital is needed to address each Invest in solutions that improve efficiency and sustainability, not just revenue Step 5: Keep Ownership at the Center Growth shouldn’t mean losing control of your business. Brasfort structured each round so funding supported operations without diluting ownership. Tips to maintain control: Use debt rather than equity for operational funding Align borrowing with cash flow, not convenience Set clear repayment plans to avoid surprises Step 6: Track Outcomes and Adjust Every funding phase should have measurable goals. Brasfort tracked: Revenue growth Margin improvement Equipment ownership Strength of internal systems Actionable Steps: Assign KPIs to each funding round Conduct monthly or quarterly reviews Adjust future funding based on results, not assumptions Step 7: Make Funding a Repeatable Practice Sustainable growth comes from turning funding into a predictable, repeatable process. Brasfort’s phased plan became a blueprint for consistent, scalable expansion. How to implement: Document every funding round and its purpose Create standard procedures for evaluation and approval Share lessons internally to improve future planning Conclusion Scaling a construction business past $10M is less about chasing every job and more about structuring capital strategically. Brasfort’s success proves: Multi-phase funding reduces risk and supports sustainable growth Aligning funding with operational goals strengthens ownership and control Documented processes make borrowing repeatable and predictable Provocative Question: Which area—capital, operations, or ownership—is holding your construction business back from $10M? Ready to build a capital strategy that fuels growth? Refer a client to National Business Capital Partner Michael Fieger today and help them scale with confidence.

Strong Revenue but No Cash? How Advisors Solve Payroll Problems

Ever Had a Client Who Looks Great on Paper- but Is Scrambling to Make Payroll? Quick summary: Some businesses look successful on paper but still struggle to pay employees. This happens when cash flow can’t keep up with growth. Smart advisors help clients spot these gaps early and use flexible funding to stay stable. This happens more often than most people think. A business can look very successful from the outside. Sales are high. Revenue is growing. Reports look strong. But behind the scenes, the owner is worried. Cash is tight. Payroll is stressful. Bills are piling up. If you’re a CPA or business advisor, you’ve likely seen this before. Let’s break it down in a simple way — why this happens, why banks often don’t help, and what smart advisors do instead. Revenue and Cash Flow Are Not the Same This is the biggest misunderstanding in business. Revenue is how much money a business earns. Cash flow is how much money is actually available right now. A business can make a lot of money on paper but still struggle to pay employees. Why? Because cash can get stuck. Common Reasons Cash Flow Gets Tight Even healthy businesses can run into cash problems because of: Customers who pay late Seasonal ups and downs Hiring new employees too fast Buying equipment or inventory Growing faster than cash can support Payroll doesn’t wait. Rent doesn’t wait. Vendors don’t wait. A Real Example From a CPA Partner A CPA reached out last month about a client. The business was doing record sales. But cash flow was still negative. Customers were slow to pay. Growth costs were adding up. Payroll was becoming stressful. The numbers looked fine. The stress was very real. Why Banks Often Don’t Help in Time When cash flow is tight, banks are usually slow. They often require: A lot of paperwork Strong credit history Long approval times By the time a bank gives an answer, payroll is already due. That delay can hurt the business. A Better Option: Flexible Business Funding Instead of sending the client to a bank, we focused on speed and flexibility. The goal was simple: Cover payroll Keep the business running Give customers time to pay their invoices Reduce stress for the owner The funding helped bridge the gap. Employees were paid. The business stayed open. Why This Matters for Advisors Business owners don’t just want reports. They want peace of mind. Advisors who help protect cash flow: Build trust Strengthen relationships Become long-term partners Helping a client survive a tough moment matters more than any spreadsheet. Simple Questions Advisors Should Ask These questions can reveal problems early: Do you always have enough cash for payroll? What happens if customers pay late? How many weeks could you operate if cash slowed down? Do you have a backup plan for cash flow gaps? Simple questions can prevent big problems. The Bottom Line Growth is exciting. But growth without cash can be dangerous. Cash flow keeps businesses alive. Advisors who help clients stay liquid, calm, and prepared become trusted partners — not just service providers. So here’s the big question: When cash flow gaps show up, what’s your go-to move? What This Means for You If you work with business owners, cash flow issues will come up — even when revenue looks strong. Having a plan before payroll stress hits can: Protect your client Reduce panic decisions Strengthen long-term trust If you’re an advisor who wants a faster, simpler way to help clients bridge cash flow gaps, flexible funding options can make a real difference. Ready to build a capital strategy that fuels growth? Refer a client to National Business Capital Partner Michael Fieger today and help them scale with confidence.

How Bravo Foods Grew Despite Bank Resistance: Flexible Funding in Action

Quick summary: Sometimes a business looks risky on paper but has real opportunities. Bravo Foods, a 13-year family-run food manufacturer, faced bank resistance even as they secured major airline contracts. By looking beyond the numbers, flexible funding helped them scale fast and capture growth. The Client Bravo Foods is a family-run food manufacturing business with 13 years of experience. They work in a highly regulated, competitive space and have built strong relationships with major airlines, including American Airlines. The Opportunity Bravo Foods won a big contract to supply thousands of meals to United Airlines. They were already supplying American Airlines, so the growth potential was huge—but the timeline was tight. To meet demand, the company needed money to: Hire additional staff Increase inventory Meet strict food safety and compliance requirements Time was critical. Waiting wasn’t an option. The Challenge Even with strong fundamentals, banks were hesitant. Recent financial statements showed losses Banks focused on historical numbers, ignoring future revenue potential Lenders paused, leaving Bravo Foods without the capital needed to act For a fast-moving opportunity, delays could mean losing the contract. Our Approach At National Business Capital, we don’t just look at one snapshot. We dug into the details and found what truly mattered: High-credit borrower Strong receivables tied to airline contracts Proven industry relationships in a specialized, high-growth sector Instead of letting past losses dictate the outcome, we focused on potential and cash flow projections. The Outcome Funding was secured quickly, allowing Bravo Foods to: Scale operations to meet airline demand Execute new contracts with confidence Strengthen its position in a specialized food manufacturing niche The projected result? A 50% increase in revenue and a clear runway for continued growth. Why National Business Capital We treat your business as more than a line on a balance sheet. When others see past losses, we see potential When fundamentals are strong, we find ways to make growth happen If your business faces bank resistance but has a real opportunity, we help you move fast Ready to build a capital strategy that fuels growth? Refer a client to National Business Capital Partner Michael Fieger today and help them scale with confidence.